“Provisional tax is merely a mechanism to pay the normal income tax liability during the tax year… an advance payment of a taxpayer’s normal tax liability.” (SARS)

To provisional taxpayers, especially those who are liable for provisional tax in both their personal capacities and as business owners, it may well seem that there are endless provisional tax deadlines and payments to be made every year.

There are indeed numerous income tax provisional and final declarations and payments that overlap across tax years, which is certainly confusing, and yet non-compliance is met with some of the harshest penalties imposed by SARS, most notably in respect of the second provisional tax declaration and payment, due by the end of February for individuals, and for companies with a February financial year end.

In this article we find out who are provisional taxpayers, what they need to pay and when and how to avoid the penalties for non-compliance.

What is provisional tax?

- Provisional tax is not a type of tax, but a cash flow mechanism to collect pre-payments of taxes that must be made in respect of individual provisional taxpayers’ and company taxpayers’ normal annual income tax prior to a final determination of the annual tax liability.

- At least two amounts are paid in advance during the year of assessment, based on estimated taxable income for the year of assessment. A third optional payment can be made.

Why must provisional tax be paid?

- Ensures government collects cash more evenly during the year and not just in bulk amounts following final tax assessments which are annual and usually in similar time periods e.g. end of December or February.

- Spreads the payment of a taxpayer’s year’s income tax liability over two or even three provisional payments.

- Prevents taxpayers facing large income tax liabilities that are only revealed at the end of the year of assessment when the annual personal income tax (PIT) return ITR12 or the annual corporate income tax (CIT) return ITR14 is filed.

- The first, second and third provisional payments are credited against any tax owing after the final income tax return is filed, and any further tax liability will then become due.

- Reduces the risk and amount of interest accruing between the time when a tax liability is determined and when it is paid.

Who must pay provisional tax?

- Provisional tax is paid by individuals who earn income other than, or in addition to, a salary or traditional remuneration paid by an employer from which PAYE deductions are made – including those who earn income from conducting a business, such as members of CCs, sole proprietors and company owners.

- Companies and trusts.

- Any person notified by the Commissioner of SARS.

- Exceptions and thresholds apply in every instance, so be sure to check with your accountant.

When is provisional tax due?

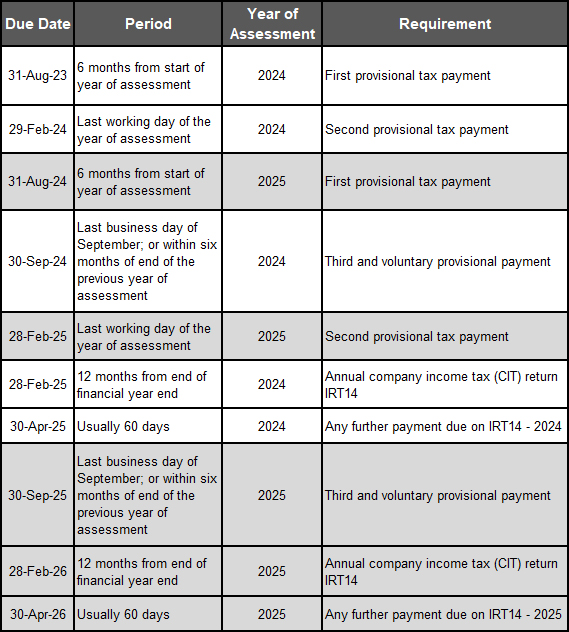

Below is an example of the provisional and final income tax due dates for:

- The 2024 year of assessment (1/03/23-29/02/24) and

- The 2025 year of assessment (1/03/24-28/02/25)

for a company with a February financial year (FY) end.

It shows how the due dates for different years of assessments overlap to create both seemingly endless provisional tax deadlines and much confusion.

The company provisional tax due dates shown in the table above are the same for individual provisional taxpayers, but individuals who are provisional taxpayers will be due to file their annual personal income tax (PIT) returns in January at the end of the tax season as announced by SARS.

How much are the provisional tax payments?

Individual provisional taxpayers

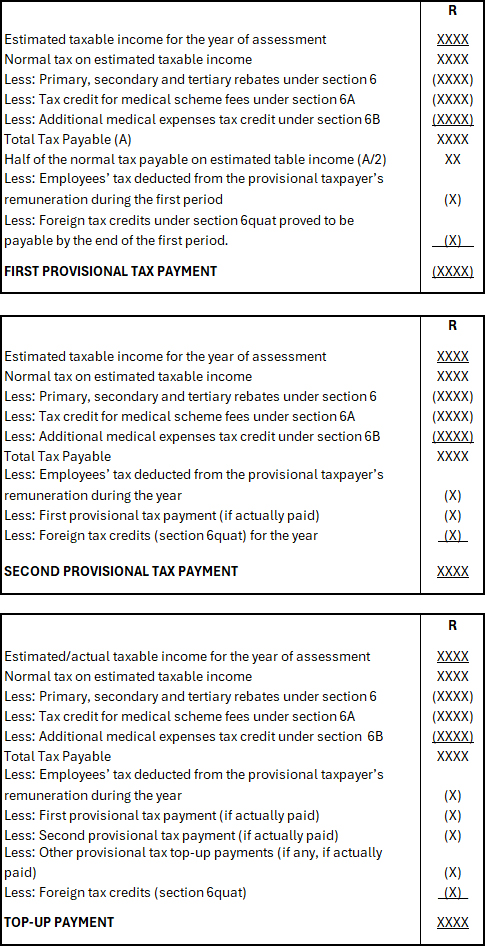

- During every period, individual provisional taxpayers must submit an estimate of their total taxable income in the year of assessment, excluding any retirement fund lump sum or withdrawal benefit or any severance benefit. The taxpayer’s estimate must be informed by a reasonable calculation.

- The taxable portion of the aggregate capital gain for the current year of assessment must be included.

- The estimate may not be less than the ‘basic amount’ which is the taxpayer’s taxable income assessed for the preceding year of assessment, less any taxable capital gain; the taxable portion of a retirement fund lump sum or withdrawal benefit or severance benefit, and other amounts specified by SARS, unless SARS approves a lesser amount. SARS can still adjust an estimate upwards that is more than the basic amount but less than a reasonably calculated amount.

- The calculations provided by SARS below show why professional assistance is optimal.

Company provisional taxpayers

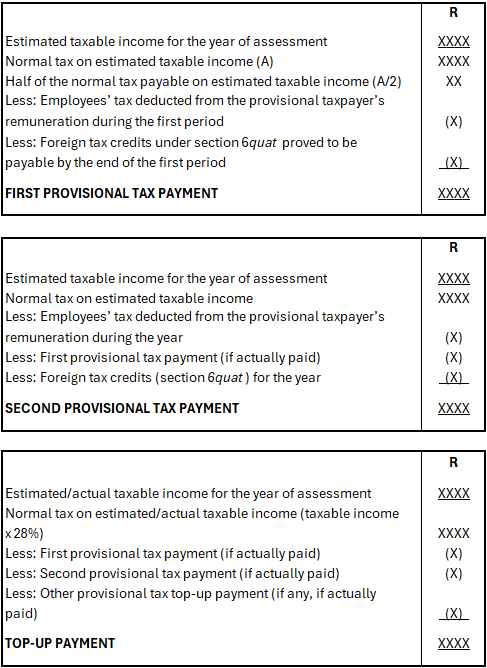

- Company provisional taxpayers must submit a return of an estimate of the total taxable income for the year of assessment.

- It cannot be less than the basic amount, which is the taxpayer’s taxable income assessed for the latest preceding year of assessment, less the amount of any taxable capital gain in that year of assessment.

- The basic amount for all taxpayers must be increased by 8% if the estimate is made more than 18 months after the end of the latest preceding year of assessment.

- The calculations provided by SARS below reveal why the assistance of your accountant is invaluable.

Top tips

- SARS can ask for the estimate to be justified and can increase the estimate if they are dissatisfied with the amount, and this is not subject to an objection or appeal.

- SARS provides the following advice: ‘the calculation must be one which has been carefully considered and is thoughtful, earnest and sincere…” and the amount of the estimate must be determined “sensibly and by careful reasoning and judgment, in a mathematical manner, and using experience, common sense and all available information”.

- Keep accurate records of all the calculations and source documents used.

How is provisional tax declared and paid?

- A provisional return or IRP6 return must be submitted by all provisional taxpayers for the first and second periods.

- Even if you or your company owes no tax, a ‘nil’ return showing taxable income is equal to zero must still be filed on time.

- If an IRP6 is filed more than four months after the deadline, SARS considers a ‘nil’ return to have been submitted – unless the actual taxable income is really zero, this will result in penalties.

What are the penalties for non-compliance?

- A 10% penalty will be levied on late payments, along with interest at the prescribed rate.

- Harsh penalties for under-estimation are levied when the actual taxable income is more than the taxable income estimated on the second provisional tax return. The penalty amount depends on whether the actual taxable income is more or less than R1 million.

- Where taxable income is more than R1 million – if the taxable income estimate for the second provisional tax payment is less than 80% of actual taxable income declared on the annual tax return, a 20% penalty will be levied on the difference between: the amount of tax payable on 80% of actual taxable income after taking into account rebates, and employees’ tax and provisional tax already paid.

- Where taxable income is less than R1 million – if the taxable income estimate for the second provisional tax payment is less than 90% of actual taxable income, and is also less than the basic amount, a penalty is levied of 20% of the difference between: employees’ tax and provisional tax paid in the year of assessment, and the lesser of (a) the normal tax payable on 90% of actual taxable income (after deductible rebates) or (b) the normal tax payable for the year of assessment on the basic amount.

- Interest at the prescribed rate (7.75% pa subject to change) will also be levied on the underpayment of provisional tax as a result of under estimation.

Rely on tax expertise

Provisional taxpayers, whether individuals or companies, should consider relying on the expertise of their accountant to assist them in preparing and/or reviewing their provisional tax and income tax returns prior to submission. Similarly, where penalties and interest have already been imposed and levied, taxpayers may need expert assistance to successfully make a request for the remission of such penalties and interest to SARS.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© CA(SA)DotNews