“Being tax compliant… is not just good for you, but also contributes to the positive growth of our country’s economy which in turn benefits all South Africans.” (SARS)

Businesses are often required to provide, confirm or share tax clearance information to another entity. This is because proof of tax compliance is an indicator of a company’s good standing in terms of its legal obligations and how well it is managed. There may be instances when an individual, another company, or a government entity needs to verify your tax compliance status, for example, during a prequalification as a supplier; for a tender application or bidding process; to confirm good standing and that your tax matters are in order with SARS; or for foreign investment allowances.

Tax clearance information is no longer confirmed via Tax Clearance Certificates – these have been replaced by SARS’ Tax Compliance Status (TCS) system, which verifies your tax status online and in real-time, and makes it very important to ensure you and your company are always compliant.

How it works now

Instead of a manual tax certificate being issued as in the past, SARS’ new system allows individuals and businesses to obtain a TCS PIN (personal identification number).

Your accountant will be able to assist with the process of applying to SARS to obtain this PIN through eFiling which requires, for example, activating the TCS for the business or individual, merging all the tax types into one registered profile, completing the Tax Compliance Status Request and selecting the correct type of TCS: good standing, tender, or – for individuals only – emigration and foreign investment allowance.

If all your tax affairs are in order, your PIN should be issued immediately via SMS or email. A unique PIN is issued for each TCS request submitted to SARS.

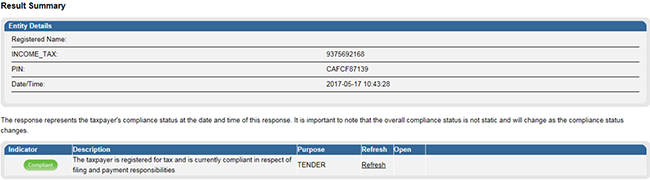

This PIN, along with your tax reference number is then sent to the third-party that requires confirmation of your or the company’s tax compliance status. To verify tax compliance status, the third-party will go to eFiling and submit your tax reference number and PIN under “New Verification Request.”

Your current tax compliance status will appear and will be colour-coded, indicating if your tax affairs are currently in order or not:

– green indicates that all tax affairs are in order and the taxpayer is tax compliant;

– red means the taxpayer is not tax compliant.

Click here to see full size screenshot

Source: SARS

It is important to note that the PIN is valid for a year and will reflect the current tax status at the date and time the PIN is entered into the TCS system (not the compliance status at the time the PIN was issued).

This means your tax compliance status on the system can change during the year in line with your tax behaviour, which might include, for example, an inadvertent late submission or missed payment. For this reason, it is crucial to continuously monitor your tax compliance status to ensure a non-compliant tax status does not impact business and other opportunities.

What is required to be tax compliant?

SARS says that the compliance status displayed reflects the following compliance requirements:

- Registration for all required tax types

- Submission of all required tax returns on time

- All tax debt settled on time

- Relevant supporting documents submitted.

To meet these requirements consistently across all the relevant tax types over the tax year, taxpayers should consider professional assistance.

Why it is so important to maintain compliance all year round?

- Remember that a TCS PIN is valid for a year and third parties with whom you share the PIN will always see your current tax compliance status, so it is crucial to ensure that status is continuously monitored and is compliant at all times during the year, to avoid a negative impact on reputation and opportunities.

- A non-compliant status can affect the confidence of potential clients, stakeholders and investors, as well as competitiveness in the market.

- Continuous compliance does involve costs or resources but will never be as expensive as the costs associated with non-compliance, which generally involve both penalties and additional fees to rectify.

- Non-compliance exposes taxpayers to wide and harsh collection or enforcement measures such as the confiscation of property, business closure, garnishee orders and agency notices. Some tax offences are also subject to custodial sentences.

- Ongoing and consistent compliance all year means that when there is an instance of non-compliance, SARS will likely be more accommodating, because a taxpayer’s track record is one of the factors SARS considers when making determinations.

- Maintaining a compliant tax status prevents tax surprises and enables lawful tax planning as well as the ability to take advantage of relevant rebates and incentives.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© CA(SA)DotNews